Last week marked a sharp divergence in global market sentiment, with Europe showcasing newfound unity and strategic direction while the US grappled with uncertainty over trade policy.

The Euro was the outstanding winner, driven by optimism around the “Coalition of the Willing” and the “ReArm Europe” initiative. These efforts reflect a structural shift towards greater fiscal expansion and defence spending, setting the stage for potential long-term resilience in European markets.

Meanwhile, the US Dollar struggled amid persistent concerns over Washington’s inconsistent trade policy. Although exemptions were granted to Canada and Mexico, the broader uncertainty surrounding future tariff decisions weighed heavily on market sentiment. This lack of clarity could potentially trigger capital outflows and further weaken the Dollar if not addressed.

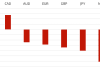

The Euro stood out as the strongest performer, rallying 4.4% against the Dollar – its best weekly performance since 2009. This surge was supported by growing investor confidence in Europe’s strategic fiscal pivot. Sterling and the Swiss Franc also posted gains, benefiting from Europe’s strengthening economic outlook.

Conversely, the Dollar closed as the weakest performer, reflecting the growing investor scepticism over US trade policy. Commodity currencies, including the Canadian and Australian Dollars, also underperformed, suggesting lingering risk-off sentiment. The Yen and Kiwi found themselves in the middle of the performance spectrum.

Oil continued its downward trajectory, marking a sixth consecutive weekly decline. WTI fell 0.4% to close at $69.92, with prices hovering near key support levels. While momentum remains bearish, significant support levels could prompt a technical reaction.

The European Commission’s commitment to mobilizing up to EUR 800B in defence spending, along with Germany’s push to loosen the “debt brake” and unlock EUR 500B for infrastructure, has been pivotal in boosting investor sentiment. These developments could significantly reshape Europe’s economic landscape, providing a buffer against external risks such as US tariffs.

Meanwhile, US economic data showed continued weakness. Employment reports, including ADP, NFP, and Challenger Job Cuts, all pointed towards labour market deterioration. This compounded the bearish pressure on the Dollar, with the DXY falling 3.4% to close at 103.905.

This week will be closely watched for further geopolitical developments and key economic data. The focus will be on inflation readings from Norway, Germany, and Japan. Additionally, US-Ukraine negotiations will remain in the spotlight, potentially influencing broader risk sentiment.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Euro Where Have You Been! first appeared on trademakers.

The post Euro Where Have You Been! first appeared on JP Fund Services.

The post Euro Where Have You Been! appeared first on JP Fund Services.